Fundamentals for Newer Directors 2014 (pdf)

The latest edition of ICI’s flagship publication shares a wealth of research and data on trends in the investment company industry.

With Paul Atkins taking the helm of the SEC, we are entering a time of tremendous opportunity to enact commonsense policies that will benefit tens of millions of current investors and help more Americans create wealth through long-term investing.

Last month, ICI released a white paper outlining a series of recommended reforms for the SEC that would update and modernize the regulatory framework under the Investment Company Act of 1940. Beyond regulation, we’re also working closely with Congress on legislative reforms. Across the legislative and regulatory environments, our reform ideas reflect ICI’s longstanding history of collaborating productively with policymakers.

We’re encouraged that the SEC and Congress have already begun to take meaningful action on some of our recommendations:

ICI is excited to rekindle our collaboration with the SEC, and we’re confident that we’ll see progress on a number of fronts.

Leadership Summit

April 30–May 2

Leadership Summit begins this week! There’s still time to register. Join industry leaders in the heart of Washington, DC, for unbeatable networking opportunities and expert insights on asset management’s biggest topics, including private markets opportunities, the tax and regulatory landscape, and AI and cybersecurity considerations.

ETF Conference

September 8–10

Join ETF sponsors, service providers, regulators, and liquidity providers in Nashville for ICI’s inaugural ETF conference to discuss trends affecting the ETF landscape. Conference registration opens in June.

Tax and Accounting Conference

October 5–8

Join industry leaders at 2025 TAC in Palm Springs to learn how the latest issues in tax and accounting affect the asset management industry.

Emerging leaders can attend ICI conferences at a discounted rate and have access to unique networking opportunities. To be eligible for the program, emerging leaders must be:

Please contact emergingleaders@ici.org with any questions.

Private markets have seen explosive growth over the past decade, with institutional and high net-worth investors capitalizing on the many opportunities and historically higher returns available in these markets. As more companies choose to remain private longer, ICI President and CEO Eric J. Pan writes in an op-ed for the Financial Times that access to the wealth-generating potential of private investments should be expanded to include retail investors. He asserts that regulated funds are the natural bridge to allow retail investors greater access to private markets, and he outlines several reforms that a Paul Atkins-led SEC should spearhead to enable regulated funds to invest in private markets.

Congress recently passed an amended budget resolution for fiscal year 2025, unlocking a reconciliation process enabling major tax-and-spending legislation to be fast-tracked. Republicans hope to leverage the reconciliation process to extend and expand on expiring tax cuts, but the sticking point remains how to pay for these extended tax breaks. That’s where ICI’s Help U.S. Retire campaign comes in—this grassroots advocacy initiative has generated more than 8,850 letters from constituents urging their legislators to preserve the tax advantages for voluntary retirement accounts. Through Help U.S. Retire, American investors are telling Congress not to touch the tax treatment of 401(k)s, IRAs, and other retirement accounts.

In fact, new ICI research supports this strong sentiment. A recent blog from ICI’s Peter Brady and Steven Bass brings fresh tax data to challenge assertions that the voluntary component of the U.S. retirement system is failing. Their analysis shows that the voluntary retirement plan system, in combination with Social Security, is working as designed, buoying American seniors’ finances and preventing steep drops in their spendable income.

Earlier this month, ICI’s Research Department published their annual survey summarizing the characteristics of mutual fund and ETF–owning households. In 2024, mutual funds continued to be the dominant investment vehicle among Americans, with 53 percent of surveyed households owning mutual funds and 13 percent owning ETFs.

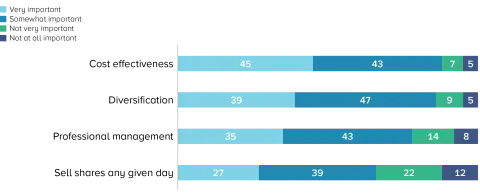

What US Households Consider When They Select Mutual Funds, 2024 finds that nearly all mutual fund investors agree that diversification, cost effectiveness, and professional management are important features of mutual funds. The survey also finds that most ETF–owning households appreciate ETFs’ key hallmarks: cost effectiveness, diversification of investments, and the ability to sell shares at any time during the day. Both mutual fund and ETF investors research fund fees and expenses, with 50 percent of mutual fund–owning households and 52 percent of ETF–owning households indicating that fund fees and expenses were very important to their fund selection decision.

Source: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey

Yesterday, ICI released our annual Fact Book. The latest edition shares a wealth of research and data on trends in the investment company industry. Visit the Fact Book website to see our newly launched data visualization tool, which puts interactive and insightful visual representations of ICI’s comprehensive statistical information at your fingertips.

On April 11, ICI submitted a letter to the newly confirmed SEC Chairman, Paul Atkins, laying out nine priority recommendations for the SEC that ICI thinks will have the greatest positive impact for investors. The letter covers five rulemaking priorities and four priorities across various non-rulemaking actions, including exemptive relief. By taking these actions, the Commission would simplify fund administration and make owning regulated funds more profitable for investors.

Some of these priorities were highlighted by then-Acting SEC Chairman Mark Uyeda at ICI’s Investment Management Conference. He stated that reproposing or reopening the comment period on certain rules was an SEC priority under the new administration. ICI is excited to be able to work in partnership with the SEC to bring commonsense rulemaking back to the asset management industry.

403(b) plans—a type of tax-deferred retirement plan similar to a 401(k) that can be used by nonprofits, school districts, and certain other tax-exempt organizations—are prohibited from holding collective investment trusts (CITs) under current federal securities law. CITs are widely available in 401(k)s and the Thrift Savings Plan for congressional staff and federal employees. The SECURE 2.0 Act of 2022 even amended the Internal Revenue Code to create CIT tax parity between 401(k) and 403(b) plans—but this legislation did not include additional changes to enable 403(b) plans to hold CITs.

Eliminating this disparity for 403(b)s is a cause being taken up by both chambers of Congress with bipartisan support. ICI has lobbied Congress to pass the Retirement Fairness for Charities and Educational Institutions Act of 2025, which would permit 403(b) plans to hold CITs. We also published an ICI Viewpoints blog post to raise awareness of the issue and the pending legislation.

In March, the European Commission (EC) published its Savings and Investment Union (SIU) Strategy, a European blueprint for savings and investment accounts. The strategy outlines the EC's goals and planned actions for the SIU over the coming years. A successful SIU will provide a boost to the European economy, empower European households to grow their long-term wealth, and is a crucial step to building the European Union’s capital markets.

ICI has worked with members and lawmakers in Europe to help shape the SIU around existing best practices. These efforts have included hosting meetings in our Brussels office exploring implications for the asset management sector. ICI believes that leveraging the Undertakings for Collective Investment in Transferable Securities (UCITS) brand will be key to unlocking the full potential of cross-border investment products and promoting the growth of deeper, more robust capital markets in Europe.

In Japan, ICI has continued to support policy initiatives to build the asset management industry and increase household engagement with capital markets. In mid-March, ICI President and CEO Eric Pan presented to members of the Liberal Democratic Party’s Asset Management Group at the National Diet of Japan about how ICI can support Japan's asset management reforms to help Japanese citizens make the shift from saving to investing. In April, the Diet group submitted a package of policy proposals to Prime Minister Shigeru Ishiba that included proposals in line with ICI’s recommendations. ICI also hosted a roundtable in April with Hideki Ito, Commissioner of the Financial Services Agency of Japan (JFSA), moderated by Eric Pan and ICI Chair George Walker.

ICI continues to partner with the Soken-sha, a Japanese financial industry focused outlet, to promote investor education and advocate for improvements to the Japanese retirement system and markets in general. The latest article educates Japanese investors on the successful transition to one-day trade settlement (T+1) in North America and the ongoing transition in European markets to inform Japan’s consideration of making the transition in the future.

In March, ICI submitted a comment letter opposing two bills in the Maryland General Assembly that would expand sales tax in the state to include many financial services, such as investment advice and asset management services. ICI argued this would make Maryland a less attractive place for asset managers to set up shop and hire new employees; plus, it would require massive logistical overhead to implement fairly and effectively. Following the comment letter and the advocacy work of ICI members and ICI’s Government Affairs Department on the ground in Annapolis, the bill was widely opposed in a public hearing and eventually had all mention of additional taxes for financial services removed.

ICI’s Government Affairs Department is also engaging carefully and constructively with state lawmakers across the U.S. on the increasingly widespread China divestment legislation. We are working to clarify legislative language, advocate for practical exemptions, and ensure the scope of any state regulation remains realistic with respect to regulated funds while respecting security interests. ICI’s State Working Group has also set up a new Task Force on this topic to support ongoing tracking, member input, and advocacy strategy.

| “Recent strong inflows may be a response to the spike in volatility in the financial markets we’ve seen lately,” said Shelly Antoniewicz, chief economist for ICI. “With short-term interest rates still at elevated levels historically, money market funds—which pass earned interest on to their shareholders—are relatively more attractive to both institutional and retail investors.” [link to article] |

|

|

Representatives Beth Van Duyne (R-TX) and Terri Sewell (D-AL) have introduced a bill [the GROWTH Act] that would defer taxation of automatically reinvested capital gain distributions in mutual funds. The move was praised by Investment Company Institute CEO Eric Pan, who said the legislation would allow Americans “to save for the long term without facing an annual tax bill.” [link to article] |

| “The outperformance of the US relative to international assets is stark, everyone knows that,” [ICI economist Shane] Worner said. “But periods of relative US outperformance are followed by periods of relative outperformance in international (ie, non-US) assets,” he added. [link to article] |

|

|

|

Eric Pan, president and CEO of the Investment Company Institute, explains why he's bullish on the ETF market.

|

Latest Comment Letters:

TEST - ICI Comment Letter Opposing Sales Tax on Additional Services in Maryland

ICI Comment Letter Opposing Sales Tax on Additional Services in Maryland

ICI Response to the European Commission on the Savings and Investments Union